What Are Investing Mistakes?

Investing Mistakes are financial decisions that reduce returns, increase risk unnecessarily, or damage long-term wealth growth. Even experienced investors can fall into these traps.

Investing is not just about choosing stocks or assets. It’s about discipline, strategy, and emotional control. One wrong move can cost thousands — or even millions — over time.

Why Investors Make Mistakes

Many Investing Mistakes happen because of emotions. Fear and greed often override logic.

Other common causes include:

- Lack of financial education

- Following social media hype

- Acting on rumors

- Trying to get rich quickly

The Cost of Poor Investment Decisions

Small errors compound over time. For example, missing just a few strong market days can significantly reduce overall returns.

Poor decisions today can delay financial goals by years.

Investing Without a Clear Plan

Investing without a strategy is like driving without a map.

No Defined Risk Tolerance

Some investors take too much risk without understanding their comfort level. When markets fall, panic follows.

Understanding your risk tolerance helps prevent emotional reactions.

Absence of Diversification

Putting all your money into one stock or asset is risky. Diversification spreads investments across multiple sectors and asset classes to reduce risk.

Letting Emotions Drive Decisions

Emotional investing leads to major Investing Mistakes.

Panic Selling During Market Drops

Markets naturally rise and fall. Selling during a downturn locks in losses.

History shows that markets tend to recover over time. Staying invested is often the wiser choice.

Chasing Hot Trends

4

Many investors jump into trending stocks without research. By the time most people invest, prices may already be inflated.

Chasing trends often leads to buying high and selling low.

Ignoring Diversification

A well-balanced portfolio might include:

- Stocks

- Bonds

- Real estate

- Index funds

Diversification reduces the impact of one poor-performing asset.

You can learn more about diversification strategies at:

https://www.investopedia.com/

Trying to Time the Market

Timing the market means attempting to predict when prices will rise or fall.

Even professional investors struggle with perfect timing. Instead of guessing, long-term investing with consistent contributions usually delivers better results.

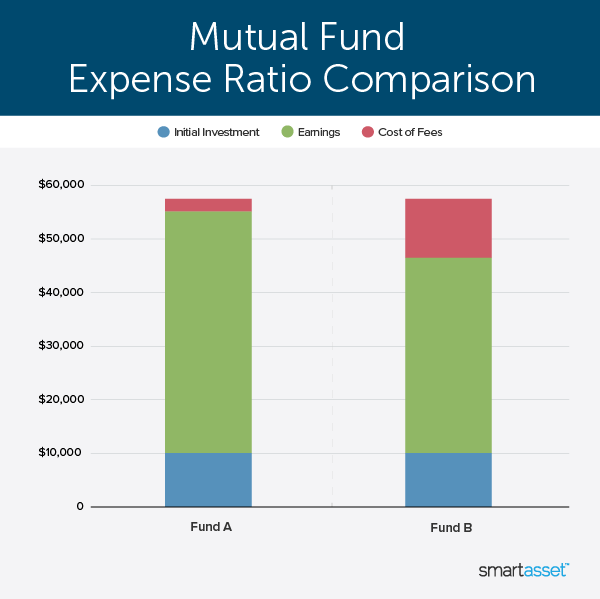

Overlooking Fees and Costs

4

Small fees can significantly reduce returns over decades.

For example:

- High expense ratios

- Trading commissions

- Management fees

Always review fee structures before investing.

Not Rebalancing Your Portfolio

Over time, certain assets grow faster than others. This can shift your asset allocation and increase risk.

Rebalancing restores your intended mix and maintains your strategy.

Failing to Research Investments

Investing without research increases risk.

Before investing, analyze:

- Company financial health

- Market trends

- Economic conditions

- Long-term growth potential

Informed decisions reduce uncertainty.

Short-Term Thinking

Investing requires patience. Markets fluctuate daily, but wealth builds gradually.

Short-term focus often leads to impulsive decisions.

Long-term investors typically benefit from compound growth.

How to Avoid Investing Mistakes

To minimize Investing Mistakes:

- Set clear financial goals

- Understand your risk tolerance

- Diversify your portfolio

- Invest consistently

- Review and rebalance regularly

- Avoid emotional reactions

Discipline is the foundation of successful investing.

Frequently Asked Questions (FAQs)

1. What is the most common Investing Mistake?

Letting emotions drive decisions, especially panic selling.

2. Is diversification really necessary?

Yes. It reduces risk and improves stability.

3. Can beginners avoid Investing Mistakes?

Yes. Education and careful planning significantly reduce errors.

4. How often should I rebalance my portfolio?

Typically once or twice per year.

5. Are high returns always good?

High returns often come with high risk. Evaluate carefully.

6. Should I follow investment trends online?

Research independently before acting on trends.

Conclusion

Investing Mistakes can cost you time, money, and peace of mind. However, with knowledge, discipline, and a clear strategy, you can avoid these costly errors.

Successful investing isn’t about perfection — it’s about consistency and patience. By staying informed and controlling emotions, you can protect your portfolio and grow wealth steadily.

Avoid the traps. Stay focused. Invest wisely.